7 Questions People are Asking During Open Enrollment 2016

As the first big deadline for the 2016 open enrollment period approaches, we’re getting many good questions from members. Below are answers to the top 7 questions we’ve been receiving:

1. Why is my doctor “in-network” on one plan from an insurance company, but not another?

Health insurance companies usually have several networks, and under different networks, different doctors will be covered. Just because your preferred doctor is covered under one network from the insurance company doesn’t mean she’s covered under all.

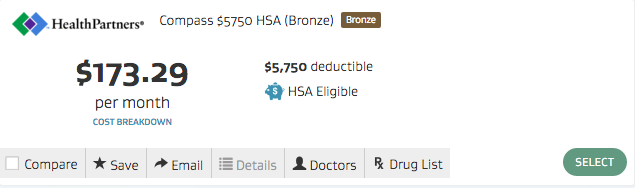

For example, you’ve narrowed your plan choices down to two options from HealthPartners in Minnesota. One is called HealthPartners Compass and one is called HealthPartners Peak. “Compass” and “Peak” are the names of two different networks under HealthPartners. You will need to visit HealthPartner’s doctor search tool and search both networks to see if your doctor is in-network under one or both of the plans. When shopping through Gravie, you can easily access each health insurance company’s doctor search tool by clicking on “Doctors” on the plan title.

Doctor searches can be confusing and Gravie advisors are always available to do the searching for you.

2. What is a co-insurance?

Co-insurance is the amount of a claim or a bill that you must pay after you’ve met your deductible; it’s your share of the cost of a healthcare service (your insurance company pays the rest). So if you have a plan with 20% coinsurance, you’ll be responsible for 20% of any bill and the health insurance company will pay the other 80%. Your coinsurance doesn’t kick in until you’ve met your deductible. This means you’ll pay the full amount of any bills until you meet the deductible.

3. What’s an embedded deductible? What does it mean on Gravie’s website if there’s a “per person” deductible and a “family” deductible?

An embedded deductible means there’s both an individual deductible and a family deductible as part of the plan. Here’s an example: there are 4 family members on a plan that has a $4,000 per person deductible and a $8,000 family deductible. The dad has a procedure done that costs $4,000. His claim will apply to his individual deductible of $4,000 and now the health insurance company will help pay any of his claims for the rest of the calendar year, at the coinsurance level (for example if the plan has 20% coinsurance, he will pay 20% of the bill and the health insurance company will pay 80%).

Since that same plan has a $8,000 family deductible, half of it has been met after the dad’s procedure. The plan will not start paying for the other family members’ claims until the full $8,000 family deductible is met. If one more family member has a $4,000 bill, the family deductible is met. Or, the three family members can have bills that total $4,000 combined, meeting the family deductible even though they haven’t met their individual deductibles. In both cases, the family deductible is met and the plan will start paying the entire family’s bills at the coinsurance level.

4. Do I lose the money in my Health Savings Account (HSA) if I don’t use it during the year?

No! That money is yours (hence the “savings account” in its name) and rolls over from year to year. It’s different from a flex spending account which is a “use or lose it” account.

5. How much money can I make and still receive a tax credit?

It depends on where you live, what your household income is, and how many people in your household you claim on your taxes. If you or your spouse’s/partner’s employer offers you a group health insurance plan, this automatically disqualifies you for tax credits. For an estimate, use Kaiser Family Foundation’s Marketplace Calculator or use Gravie’s calculator when shopping. To find out the exact amount you’re eligible for, you will need to apply for the tax credits through the federal exchange or through a state exchange, depending on where you live. Gravie can help you apply for these tax credits.

6. How long do I have to decide which plan I want?

For your plan to start covering you January 1, 2016 you must enroll by December 15 of this year. If you miss the deadline, you have until January 15 to get coverage starting February 1. If you miss the January 15 deadline you have until January 31 to get coverage starting March 1; this is the final deadline of open enrollment 2016.

If you want coverage to start January 1, we suggest you choose a plan by December 10, just to make sure everything’s in line to meet the December 15 deadline.

7. Does my family all have to be on the same plan?

Nope. Family members can choose different plans. Keep in mind that this means you’ll have separate deductibles and possibly different networks, but yes, you can choose to have a different plan for a different family member. This might make sense if you have a family member with more specialized health needs. Gravie advisors can help you set up multiple plans for your family if need be.

If you or your employees need additional questions answered during open enrollment, our advisors are available at 800.501.2920 or help@gravie.com. Interested in Gravie for your employees? Contact us here.